Economic Update

September Economic Update

- Earnings season in US beats expectations, noting that expectations were lower due to COVID-19

- The US market buoyed by large Tech companies still leading the charge

- Australian jobs data show some strength but not out of the woods yet

The Big Picture

Australian Equities

Foreign Equities

Bonds and Interest Rates

Other Assets

Australia

China

US

Europe

Rest of the World

Economic Update – August 2020

Within this month’s update, we share with you a snapshot of economic occurrences both nationally and from around the globe.

The rally in equities continues

– The ASX 200 and S&P 500 both posted four months of positive returns

– China economic data are getting back to pre-COVID levels

We hope you find this month’s Economic Update as informative as always. If you have any feedback or would like to discuss any aspect of this report, please contact us.

The Big Picture

Equities listed on the ASX 200, Wall Street (S&P 500), the world and emerging markets indices all posted a fourth successive month of positive returns in July – although the ASX 200 gave up much of its July gains on the last day.

The S&P 500 just posted its best July gains in 10 years – an impressive +5.5%. Much of the recent gains on this index can be attributed to the mega-cap tech stocks including Amazon and Facebook. Indeed, if the tech stocks are stripped out of the S&P 500, its performance has only been modest.

Reporting season, when companies reveal their latest balance sheets and outlooks for the future, is well under way in the US for the June quarter. Reporting season is just about to start in Australia for the half year.

There have been some blockbuster corporate earnings reports on Wall Street but also a number of big misses. Success and failure have been roughly aligned with the ‘stay-at-home’ stocks like Amazon and Netflix vs COVID shutdown economies such as Airlines and hospitality stocks. Facebook and other internet companies have largely done very well – as have a number of the drug companies. The obvious suspects for entertainment outside of the home continue to struggle.

With many regions re-introducing opening restrictions on restaurants and bars to counteract the second wave, the global economy will struggle to get back to normal anytime soon. However, there are some bright spots.

China posted a massive 11.5% for June quarter economic growth against an expectation of 9.6%. On an annual basis, the outcome was obviously more modest at 3.2%. China trade data beat expectations on both exports and imports. The purchasing managers indexes (PMI) a measure of input demand, for both manufacturing and services were also strong.

While the US posted a widely expected large negative growth figure for GDP, retail sales are almost back to where they were before the COVID virus spread to the US.

Australia created 210,800 new jobs for the latest month but all of these were part-time. Indeed, full-time jobs actually went backwards. The unemployment rate came in at the expected 7.4%. The Reserve Bank of Australia (RBA) stated that its general economic outlook had been too pessimistic earlier in the year. It still expects unemployment to be 9.3% at the end of 2020 which is well below the peak experienced in the last recession nearly 30 years ago.

Australian inflation was reported to be 1.9% for the latest quarter – the lowest result in over 70 years. However, there were very special circumstances to explain this fall in prices. Childcare had become free for many and oil prices plummeted which created a big fall in petrol prices. Since the price of both of these items will likely ‘return to normal’ in the current quarter, a very large positive inflation figure is likely next time around.

It is important to note that the RBA’s preferred measure of inflation, that removes wild fluctuations in some items, was a much more modest 0.1% for the latest quarter – almost flat.

The European Union (EU) announced a 750 bn euro stimulus package to support COVID-affected people and businesses. The US senate republicans laid out a $1 trillion package for a similar purpose. Given their system of government, the republicans must now negotiate with the democrats before it can become law. This will delay the outcome somewhat.

Interestingly, in Australia a large number of people entered the workforce as unemployed in the latest data. The opposite of this behaviour is often referred to as the ‘discouraged worker effect’ as recessions loom and people give up looking for work. Perhaps we should refer to recent moves in data as an ‘encouraged worker effect’!

Also, on the bright side, at least three companies in the US are building up a stockpile of COVID-19 vaccines in anticipation of their drugs being validated by current clinical trials for approval by the US authorities. A similar situation is occurring in Queensland and the highly publicised Oxford university project.

Usually, clinical trials are completed before production commences because of the risk of wasting money on the production of drugs that turn out to be unsuccessful. The current ‘parallel production processes’ have been made possible by government financing. No corners are being cut in developing vaccines. The stocks of ineffective or bad drugs will be destroyed if and when appropriate.

Therefore, the 12-18 months minimum lead-time for vaccines that we reported on a few months ago has been dramatically reduced by these public-private partnerships. Given the number of different vaccines being developed, we think it is quite reasonable to expect one or more vaccines to be on the market from the end of this year. If that happens, we also expect stocks markets to rally from wherever they are at the time.

Australian Equities

The ASX 200 had a positive month in July (+0.5%) in spite of losing more than 2% on the last day! Normally companies ‘confess’ in the weeks before the reporting seasons of August and February so that they cannot be accused of misleading investors when adverse figures are expected.

Confession season has been relatively quite this time around as much of the ‘confessions’ were made earlier in the year as the lock-down came into force. Therefore, we do not expect as much short-term volatility from any poor results as we might normally expect. Weaker results have largely been priced in.

Growth stocks, as opposed to value stocks, continue to dominate ASX 200 returns. We think that this momentum will continue at least for a little while.

Foreign Equities

The S&P 500, the world index and emerging markets all performed well in July – for the fourth month in a row. Indeed, July’s +5.5% on the S&P 500 marked the best July result in 10 years! The tech sector continues to dominate Wall Street’s performance and this is likely to continue as most of the big tech companies beat expectations at the end of July.

Bonds and Interest Rates

The US Federal Reserve (Fed) concluded its major meeting at the end of July with interest rates on hold and a statement that policy will err on the side of expecting poor results. Markets liked this, and initially rallied. The shorter-term US interest rates are now quite depressed with maturities out to 3 years all about the same, close to zero. However, for 10-year government bonds the yelled is 0.55%.

The RBA was also on hold and stated that, in hindsight, it was too pessimistic about the economy earlier in the year. Rates continue to be expected to be lower for longer.

Other Assets

Australia

210,800 new jobs were created when ‘only’ 112,500 were expected. All of the new jobs were part-time. Full-time jobs were lost in June. These data points are consistent with restaurants and bars re-opening at less than full-capacity.

The June quarter inflation figure came in at a more than 70-year low at 1.9%. The trimmed mean, preferred by the RBA because it strips out volatile items was less dramatic at 0.1%. As the price of oil and childcare comes back to previous levels, the next read should be strongly positive but of little concern on its own. December 2020 quarter inflation should be a better indicator of underlying demand.

Victoria has re-imposed strong lock-down restrictions on its residents. Queensland has instituted travel bans from most people outside of that state. Hot spots are emerging in parts of Greater Sydney.

China

China’s PMI for manufacturing came in at 51.1 against an expectation of 50.7 and the services PMI continued to be very strong at 54.2. These data, released at the end of July backed up the recent stronger GDP growth data.

China’s March quarter growth was 6.8% on an annualised basis and this jumped strongly to +3.2% in the June quarter against an expected 2.5%. The quarter-on-quarter growth in June was an impressive 11.5%. Both exports and imports beat expectations. It would appear that China is already coming out of its first quarter slowdown.

US

US June quarter growth came in at a massive 32.9% but some of this figure is due to a statistical aberration. In the US they calculate the quarter on quarter growth rate and scale it up to an annualised figure (using the compound interest formula). It does not mean that GDP is 32.9% less than it was a year before! Rather, Q2 was approximately -9.5% quarter-on-quarter growth. We fully expect a bounce back in the September quarter.

US Non-farm payrolls data reported 4.8 million new jobs created but that leaves a lot of US people who lost jobs in recent months still on the sidelines. The latest unemployment rate is 11.1% but this rate is less than the previous month’s rate of 13.1%.

Of great importance to us is the latest Citibank surprise index. This bank collates consensus forecasts and outcomes for many important economic data series. The surprise index measures the proportion of times the outcomes were better than the consensus forecasts. The index was close to 100% near the end of July indicating forecasters had been far too pessimistic.

We continue to believe that the US and other countries are coming out of the effect of the lock-down more quickly than many, including ourselves, however, there is a long way to go particularly as hot spots flare up and policy responses react accordingly.

Europe

Economic Update – July 2020

Within this month’s update, we share with you a snapshot of economic occurrences both nationally and from around the globe.

– The US Federal Reserve continues to support markets

We hope you find this month’s Economic Update as informative as always. If you have any feedback or would like to discuss any aspect of this report, please contact our office.

The Big Picture

The bumper rally in Australian equities starting from the March 23rd 2020 low appears to be pausing as we enter a new financial year. There are many unknowns – not least of which include how the COVID-19 pandemic will playout, and how the November 2020 US presidential election will influence markets.

The financial year just ending (FY20) did produce a moderate negative return of -7.7% for Australian shares even after including dividends being re-invested. But, to put that loss in perspective, it is only the second loss in the 11 financial years since the post-GFC rally started in mid-2009! Moreover, it does not appear to us that the longer run rally will end anytime soon as many central banks are still operating under very loose monetary conditions.

It is very difficult to predict how the COVID-19 pandemic will play out given there are no vaccines or cures yet available – and may not be for another 12 months. There are signs in some regions, and some of the southern US states, that a material second wave is taking hold. Australia has fared comparatively well, however the state of Victoria has placed 30 suburbs of Melbourne back into lockdown due to a rapid increase in localised infections.

Since we now have far more knowledge and available resources than when the virus first struck, we think it is reasonable to assume that authorities will be able to better manage the spread and impact of the virus from here without the almost global shut-down of economies witnessed in the second quarter of 2020.

As restrictions are being relaxed, there are signs that economic recoveries are under way. We argued that the sharp negative growth figures we saw earlier this year – and still in some regions – should not be overly dwelt upon. We take the same measured view about the magnitude of the recovery figures.

In June US retail sales grew by 17.7% for the month and house sales by 16.6%. Australian retail sales grew by 16.3%. And China posted a 6% monthly gain in industrial profits – the first positive results since November! These are, of course, historically very high numbers. Our take-away is not the magnitude of these data points, but the timing. The recovery has started a couple of months before we and most others thought likely. And that is very welcome news indeed.

If the pick-up is faster than most expected, it is no surprise that we infer the market sell-offs into March were likely over-done. Some commentators are saying that the June quarter (Q2) rally was too strong. That is only the case if the over-sold notion is not taken into account. Either way, a strong rally into the end of a quarter (and our financial year) tempts fund managers to lock in some gains for window dressing and tax management purposes.

Until our company reporting season starts in August (and the US second quarter results start soon) we do not have much insight as to what companies really think the future looks like.

It is true that the US has called that their economy went into recession in February of this year. With our 0.3% result for quarter one growth and a likely big negative number for quarter two, we can reasonably conclude that we are in recession too.

However, US and Australia unemployment numbers are lower than one might expect in a ‘normal’ recession. These shut-down induced recessions are very different from the traditional ‘standard’ recession. The IMF has predicted global growth for 2020 to be 4.9% but that needs to be analysed in conjunction with the possible speed of the recovery.

Australian Equities

The ASX 200 had a strong June posting a capital gain of +2.5% which was in line with the world market. However, capital gains for the financial year (FY20) were down 10.9% or 7.7% when re-invested dividends are included.

While FY20 was poor for the Australian index, two sectors stood out as very strong pockets of growth. The health sector gains were +25.7% and the IT sector gains were +18.0%.

We judge the market to be modestly under-priced but that call must be considered in the light of company earnings forecasts and outlooks seemingly lagging behind actual events. This situation should become clearer as our August reporting season gets under way.

Foreign Equities

The S&P 500 gains in June slightly lagged behind the ASX 200 with a gain of +1.8%. However, the US Dow Jones Index had the best Q2 since 1987; the S&P 500 had the best Q2 for 22 years; the Nasdaq broke through 10,000 for the first time and recorded gains of 24.4% in the last 12 months (our FY20). Europe posted the best quarterly gains for five years. Of course, Q1 (the March quarter) was very bad for most indexes so Q2 should not be viewed in isolation.

Bonds and Interest Rates

There has been little movement in official rates because they are effectively at the floor (at zero or negative). However, central banks have been trying to influence longer rates with quantitative easing (QE).

From June, the Fed is now able to purchase individual corporate bonds and it is committed to at least $120bn purchases per month of Treasuries and Mortgage Backed Securities until the end of 2022. That is much bigger than the QE during the GFC. It has also stated that the reference rate will not be increased at least until after 2022.

The governor of the Reserve Bank of Australia (RBA) stated that the official rate will be low for years to come.

These actions by central banks make investing in equities more appealing than they otherwise would be. Some call it the equivalent to a ‘put option’ (or floor) on the market. Volatility will still persist but money has to find a home that will pay a yield. Equities currently have the best chance of producing a reasonable income stream out of the standard asset classes.

Other Assets

Although there is still price volatility in commodities, prices are far more stable than they were a month or two ago. There has been increased commitment to controlling the supply of oil helping those prices stay well away from the May lows.

Austrailia

First quarter GDP growth came in at 0.3% signalling the probable start to (at least) two quarters of negative growth which would be enough to call a ‘recession’ using the simplistic rule of two consecutive quarters of negative growth.

However, it should be stressed that growth over the year was still positive at +1.4%! All is not yet lost.

However, the unemployment rate is still only 7.1% which is well below the levels of previous ‘standard’ recessions. With the economy starting to reopen, unemployment may not worsen much more.

With Prime Minister Morrison launching $1.5bn worth of ‘shovel ready’ infrastructure projects in June, and it seems likely that ‘Job-keeper’ and other such schemes in some form are likely to continue, the government fiscal policy is aimed at supporting economic recovery.

China

China is flexing its muscles over Hong Kong and the US is getting involved. While it might be laudable to come to Hong Kong’s assistance (even trying to bring in Europe) there could be some very bad consequences for trade and global growth should this situation escalate.

Industrial production up +6% bounced back in the latest China data – the first positive since November. Hong Kong re-opened its Disneyland facility – albeit with some restrictions.

Both the manufacturing and services PMIs (Purchasing Managers’ Index) beat expectations. The manufacturing sector expanded for a fourth straight month at 50.9. The services sector PMI was up one point at 54.4 over the previous month.

US

President Trump has slipped well behind Democratic contender Biden in the early election polls. However, Trump leads in ‘dealing with the economy’ so it is hard to predict who will win the election when ‘the chips are down’. If Biden wins, tax increases are on the agenda to address the widening income and wealth inequalities. However, it is unlikely anyone would try to raise taxes while the economy is so fragile.

Europe

There is little doubt that the fortunes of Europe are not as important as they once were considered to be. The possible fallout from a Grexit or a Brexit are no longer major issues. The UK even seems to be in a position to do a trade deal with Europe in July – well before the December 31st 2020 deadline.

Europe’s economic data has been as bad as elsewhere. But Europe is not as key to US and Australian economic success as it was previously. When Europe looked likely to implode (in around 2001-2013), it mattered a lot more.

Rest of the World

Japan was forced to reconsider the re-opening of its economy. The latest industrial output data was 8.4% for the month. Japan has not yet turned the corner as possibly the US and Australia have economically.

China passed laws to control certain aspects of its security relationship with Hong Kong to take effect from July 1st. The US is unlikely to remain quiet on this point and an adverse trade response is quite possible.

Economic Update – June 2020

Within this month’s update, we share with you a snapshot of economic occurrences both nationally and from around the globe.

The recovery continues

- Equities continue to climb the wall of what appears to be ‘less worry’

- Economies are starting to re-open which is providing further support for equities

- Central banks and Governments continue to apply rescue measures as COVID-19 continues to see increased infections dampening social and economic activity.

We hope you find this month’s Economic Update as informative as always. If you have any feedback or would like to discuss any aspect of this report, please contact our team.

The Big Picture

We started last month’s update with the thought that the worst could be behind us but that volatility might still spook markets for a while to come. A quick look at key equity markets tells a more positive story for May with the ASX 200 adding 4.2% to the 8.8% gained in April. The S&P 500 added 4.5% to the 12.7% gained in April.

We still think it’s too soon to assume normal reliance on macroeconomic data. We expected the numbers to remain volatile and we were not disappointed.

The big picture we are focusing on is the mood in the markets about re-opening economies. In one month, we have gone from dire predictions of nothing opening to what looks like an orderly opening in Australia, the US and Europe. Yes, there are pockets of confusion but the stock markets seem to have been buoyed by the fact that an orderly return to work is already beginning to happen.

So long as there is one person carrying the virus there is a chance for others to contract it. There is a very high probability of a second wave. The question is – what form will that wave take?

In Australia, the shut-downs seem to have been largely successful. When someone in a newly opened bar or café contracts the disease, quickly responding to those exposed can minimise the spread. If left unchecked we can easily get back to the problem we had a month or so ago.

Of course, the systems and equipment we now have in place are better to deal with a new outbreak. Australians, by and large, appear to be reasonably responsible. Contrast that with the situation in the USA. There seem to be large clusters of vocal groups claiming all sorts of rights regarding employment and social mobility. It does not matter whose philosophy is correct, viruses only react to people close at hand. We would not be surprised if the relaxing of containment measures proves to be premature and a fresh outbreak occurred in the US and it might be big enough to unsettle markets. In light of the recent social unrest the potential for further outbreaks has likely increased. This will weigh on investment decisions.

Governments and central banks are still applying fiscal and monetary support in amounts that should assist to avert a further escalation of the economic impacts of the COVID-19 crisis. However, at the individual level some groups might be relatively disadvantaged.

Going forward, we are naturally keeping an eye on fresh outbreaks of COVID-19, potential vaccines and cures. They are all potential games changers.

Given the speed of the re-opening of Australia and the US we might expect to see some meaningful data on unemployment from July (to be reported from August). Until then our focus is more on intuition as meaningful forward looking data remains scarce. As economic data releases and in particular corporate earnings estimates stabilise, we will again be able to produce a more informed outlook.

Asset Classes

Australian Equities

The ASX 200 posted a strong +4.2% gain over May with a few sectors standing out. IT (+14.5%), Materials (+8.0%), Property (+7.0%), Telcos (+6.0%) and Financials (+4.7%) were the strongest sectors.

Based on the growing belief that we at least appear to have COVID-19 contained, then the market from a relative value sense is somewhat attractive but with ongoing uncertainty volatility will remain elevated.

Foreign Equities

The S&P 500 posted a +4.5% gain in May which followed a +12.7% gain in April. However, the S&P 500 is down ?5.8% on the year-to-date.

Many analysts have been quick to point out that the gains in recent years have been mainly concentrated in about 6 or 7 big tech stocks. Without those stocks, they say Wall Street would have just moved sideways.

Index investors need not overly worry about the concentration of strength in stock returns. Others need to be more careful about how they construct portfolios as COVID-19 and the respective Government and Central Bank responses to it have increased the relative attractiveness of some stocks and in particular, some industry sectors over others.

Bonds and Interest Rates

With most national bond rates close to zero, there is not much room for rates to move. We do not expect any of the major countries will be raising official rates any time soon.

With rates low, investors still have to consider deriving some yield from equities.

Other Assets

April was clouded by wild gyrations in the price of oil. West Texas Intermediate (WTI) prices even went negative mid-month as people got caught with the ending of the May futures contract.

We flagged that a repeat situation might occur in mid-May but no such disruption happened. Indeed, WTI oil prices (the relevant US price) were up 88% over May while Brent (the world price) was up 39.8%.

The OPEC problems and shortage of world demand are still big issues but the issue with the futures contracts seems largely contained for now.

After big changes during May the prices of iron ore, copper and oil finished May close to their intra-month highs. It is important for global stability for these commodity prices to stabilise at reasonable levels. At last, that seems to be happening. The Australian dollar (against the US) also finished May at near the intra-month high.

COVID-19 Review

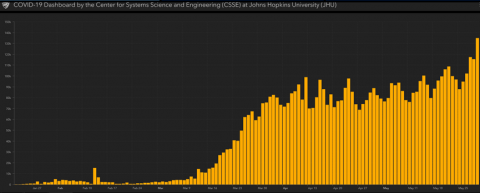

The chart below is the latest from Johns Hopkins University Coronavirus Resource Centre.

The message is quite clear, the reported cases of COVID-19 continues to rise globally while we here in Australia have fared better than most, if not all. The reporting of COVID-19 cases is now escalating in the emerging economies of Brazil, India, Russia and counties in the middle East. Notwithstanding the US has reported circa 1.8 million cases which is in excess of three times that of Brazil in second place at 514,000.

While we in Australia are beginning to see a relaxing of containment measures, the real challenge is that other countries are also heading down this path. Whilst they have achieved apparent containment (i.e. they have flattened the rate of increase in infections), they are still dealing with many actual cases. Consequently, the risk of a second wave is statistically higher for them. While we hope the relaxing of restrictions more generally is successful and does not lead to a second wave of the virus, it is too early to tell and the situation will remain dynamic, despite the more positive experience we are having in Australia.

Regional Review

Austrailia

Australia’s process of gradually returning to work is becoming politicised after several months of apparent bipartisanship. RBA Governor Philip Lowe highlighted that the September quarter proposed unwinding of Job Keeper and Job seeker payments may be premature. The market appears to be running ahead of the economy at this point.

China

China and the US are at it again but Trump’s end-of-month speech did not bring up the possibility of an escalation of the trade war.

China’s relationship with Hong Kong is still being thrashed out. COVID-19 did little to distract the protagonists.

US

Pockets of the US economy are aggressively re-opening. We are not filled with confidence that the whole process will go smoothly. US citizens seem fixated on their constitutional rights rather than what might be good for the economy at this point.

Europe

The EU has proposed another $1.2 billion recovery fund to assist member countries to weather the recession resulting from the Covid crisis as virtually all member countries have broken EU deficit limits as they support healthcare and businesses to try and sustain their economies.

Rest of the World

Perhaps by next month, news on the rest of the world will match the importance of news on a global pandemic. For now, we focus on how restrictions are relaxed and how lagging economies will be funded.

Economic Update – May 2020

Within this month’s update, we share with you a snapshot of economic occurrences both nationally and from around the globe.

The recovery begins?

– Equities bounce back strongly in April as unprecedented fiscal and monetary stimulus applied

– Economies in early stages of starting to re-open as the COVID-19 rates of infection have slowed

– Oil prices face turbulent times and demand falls dramatically absorbing OPEC production cuts

We hope you find this month’s Economic Update as informative as always. If you have any feedback or would like to discuss any aspect of this report, please contact our team.

The Big Picture

After a really tough month for stock markets in March, the bounce back in April gave investors a chance to catch their breath. Of course, it is possible a new low will be formed at some time in the future but the news on COVID-19 is starting to get better.

It was quite rational for markets to have fallen as sharply as they did in March. After all, no one knew the extent of the devastation that the virus would cause. As soon as governments and central banks responded with stimuli, lock-downs and social distancing, markets realised that they had sold off too much.

We think the major markets are still cheap based on reported earnings but volatility and fear are elevated. As a result, the rate of price appreciation going forward over the longer term versus what we think of as fair pricing might be slower than what we experienced in April.

There have been so many stimulus packages and healthcare innovations, it is an impossible task to report all. And new changes are coming through with such speed that any attempted comprehensive report would rapidly be out of date. In the space of a month, global sentiment seems to have gone from doom and gloom in markets to ‘it’s not that bad’ after all.

We think the important take-away is that almost all major countries are rapidly responding to the challenges – unlike in the wake of the GFC in 2008 and 2009. Health authorities and scientists are seemingly working tirelessly to develop vaccines and provide cures. We think we are in safe hands! But Trump did take issue with the World Health Organisation (WHO) over their early responses (or lack thereof) to the onset of the crisis.

There are questions about whether or not people who have experienced a COVID-19 illness can be re-infected. As finance experts, we have nothing to offer on that question but we do take this uncertainty into account.

Many countries have already started to relax the lock-down restrictions – mostly in a phased fashion. It makes sense to respond in this fashion as it would be imprudent to run economies into the ground to ensure, like smallpox, the disease has been eradicated. That means that there will be future waves of infection in much the same way that there are usually weaker aftershocks following an earthquake. Because different regions are loosening restrictions in different ways there is a chance to learn from one another.

All economic data will likely be really bad for many weeks and possibly months – so there is no point in dwelling on them. If we look for a medical analogy, economies are experiencing ‘self-induced comas’ to allow doctors to deal with the patients’ needs in a timely fashion – rather than dealing with a recession-like trauma rapid-fire scenario in the ER.

Another point worth noting for less experienced readers is the bias that most forecasters put into some of their forecasts. It is well known that forecasters often indulge in so-called ‘rational cheating’ to use an academic term. It is often not in the best interests of the forecaster to publish their ‘honest’ best forecast but rather modify it in the light of the consequences of being wrong.

In the current situation, a forecaster who believes economies will be back to normal in short order would be well-advised not to say so. If the economy actually takes a longer time to recover, the optimistic forecaster is likely to be the object of much scorn. If the optimist is right, there are no particular prizes to win. On the other hand, a forecaster who overstates the time for recovery (at least by a little) will lose nothing if, indeed, it takes a long time. If a quick recovery happens, everyone is so happy that they ignore that the forecaster was, in fact, wrong.

With this bias in mind, we suggest that the consensus view for recovery that is published might be biased towards the longer run. Recall all of the eminent economists (including Nobel Laureates) who said, following the GFC, that a depression longer than the Great Depression was likely. How wrong they were – but can you now name them?

The impact of COVID-19 was more than enough for analysts to try and work through during April but oil prices also went into a tail spin! The timing of the two phenomena might be related as it is thought Saudi Arabia has been waiting for the opportunity to run the relatively new US shale-oil producers out of business. What better time is there to attempt such a price war than one in which people were already hurting?

There is always the incentive for independent oil producers to compete for market share – which is why OPEC was formed in 1973. Since Russia and the US are big oil producers that are not OPEC members, price control by OPEC is limited. In an attempt to become self-sufficient in oil, the US has turned to extracting oil from shale as well as oil wells. We ‘passed’ on such ‘fracking’ in Australia.

Shale oil is now such an important component of US production that its output had a depressing impact on global oil prices.

OPEC+ (i.e. including Russia and a few smaller independent players) agreed earlier in April to a material supply cut to start from May 1st. However, the massive lack of demand due to COVID-reduced travel on land, sea and air has made even that cut insufficient to stabilise markets.

The US has a massive underground oil storage facility in the centre of the country (Cushing, Oklahoma). It is nearly full so that there is nowhere for more US oil (known as WTI or West Texas Intermediate) to be stored. As a result, many players had to sell their forward contracts at negative prices to prevent being forced to take delivery! This is a phenomenon that is likely to recur monthly as each forward contract nears expiry (the next is due on May 19).

The global price of oil (known as Brent) has been more stable but it has still been impacted through interdependencies. The Saudis reportedly can withstand these price gyrations for many months if not longer. However, the newer shale-oil producers are less cost effective and the first bankruptcy proceedings have already started.

The oil price war is unlikely to have a major detrimental impact on the market in the longer term but these oil price spikes do seem to cause excess volatility in stock market indexes along the way.

With regard to COVID-19 and oil prices, we believe that the prudent investor who started the year with an appropriately diversified portfolio should probably stick with it. Even experienced fund managers find it difficult to pick the right time to buy and sell. And this suggestion brings us to the opportunity many people are now faced with in super funds as some are able to withdraw up to $20,000.

Super is a wonderful, tax-effective way to save and should be preserved if possible. For many people, $20,000 is a sizeable chunk of their savings. Assuming a balanced rate of return of 7% pa on investments with an inflation rate of 2.5% pa, a 30-year old person due to retire at 67 would be forgoing $244,472 at retirement (or $101,937 adjusted for inflation). Compound interest is a powerful force! Early exit can be massively expensive in the long run for the young.

Of course, some people might have no option but to withdraw the $20,000 or part thereof but it would be wise to look for alternative solutions first and, perhaps, not taking out the maximum amount even if alternatives are not available.

The withdrawal is reportedly more problematic with some industry super funds. The TV adverts often point to the superior returns of industry super funds over retail funds. In making such a comparison and in considering the maximum $20,000 withdrawal, it is important to take into account the reported fact that many industry funds are more heavily invested in ‘unlisted assets’ such as property and infrastructure that are not listed on the stock exchange – some funds reportedly have allocations of up to 40% in such unlisted assets.

The price of, say, CBA shares is priced by the second during the time the stock exchange is open and the stock is not in a trading halt. If any average investor sells all of their CBA stock the impact of the sale on the latest price is minimal. However, if the same investor tried to sell all of their stock in a company outside of the top 300, there could be a material price fall. This price fall in ‘illiquid’ stocks should be considered when considering a sale and it is why many investors should only consider the top 50 or top 100 stocks.

An unlisted asset, such as a large (unlisted) building has no transparent market price. Rather, a valuer infrequently makes a judgement as to what price could be realised. Unlisted assets appear to be less volatile because no one is valuing them often enough to detect the true pricing volatility!

Also, when an investor attempts to sell a part of an unlisted asset there is no ready market of buyers. At any point in time, one can view the ‘order queue’ of what potential buyers and sellers will trade a listed share on the ASX.

If one super fund, industry or otherwise, is heavily invested in one particular unlisted asset and a large number of members want to redeem capital, the potential sale of the unlisted asset could destabilise the value of the fund as the price ultimately realised may be less than the value of the asset reported by the super fund. Given that some industry funds are reportedly as much as 40% invested in unlisted assets, those funds might be forced to sell just their liquid assets instead making the resultant asset allocation even more skewed to the illiquid, unlisted side. We think it is important to take proper financial advice whenever possible concerning such withdrawals.

We hope to be able to paint a clearer picture next month as the dust on COVID-19 settles. The current company reports for quarter one in the US are giving little guidance to the future. Therefore, we must rely on our broader macro view of the longer term as we have presented in this section.

Asset Classes

Australian Equities

The ASX 200 posted a strong gain over April (+8.8%) but this should be considered in conjunction with the ‘bear market’ sized fall in March.

Financials did relatively poorly in April in part due to the NAB trading halt – when they announced a cut in dividends and a dilution of capital through a capital raising. ANZ announced that it will defer its dividend. The other big banks also took capital losses as investors anticipated similar behaviour elsewhere in the sector – as we foreshadowed might happen in last month’s newsletter.

In spite of the oil price war, both the energy and materials sectors – making the combined resources sector – performed very well.

Market volatility has fallen sharply since the March high but it is still nearly double what we might expected in normal times.

Foreign Equities

The S&P 500 performed even better than the Australian market (+12.7%). Other major markets moved more in line with the ASX 200.

The VIX so-called fear gauge remains quite elevated but far below its record highs in March.

Bonds and Interest Rates

Several central banks have committed to continue to support government and corporate bonds. The Bank of Japan (BoJ) went so far as to state that it has an unlimited target of what QE (quantitative easing) it is prepared to use.

The US Federal Reserve (Fed) is also being creative in trying to support bonds of all maturities. At its April meeting it reiterated its plan to keep rates low at least until the economy returns to full employment.

We still expect our rates to be lower for longer and for longer-dated bonds to have a higher yield than the short-dated.

Other Assets

The WTI futures contract price of oil for May delivery even went negative at one point during April but both WTI and Brent prices, while highly volatile, have recovered somewhat.

The Australian dollar has continued to be unusually volatile fluctuating in a range from US60.35c to US65.66c in April.

Iron ore prices have been relatively stable but copper prices rose by 6%.

Regional Review

Australia

The rate of new COVID-19 cases has slowed to a mere trickle in Australia. As a result, governments are starting to relax some of the lock-down restrictions. Since the rules vary by state, and they keep changing within states, there is seemingly much confusion about what is legal and/or wise.

Although new cases are few and far between, there are plenty of people with the virus to infect others as restrictions are relaxed. Undoubtedly there will be future (hopefully much smaller) waves of infection.

The March unemployment rate published in April surprised many as it fell from 5.3% to 5.1%. However, the data are gleaned from a survey conducted in the first two weeks of the month (March) – before the lock-down started.

China

The China economy is starting to gear up again but at a slower pace than many expected. One reason could be the lack of demand and logistics in other countries. For the second month in a row the Purchasing Managers Indexes (PMI) for both manufacturing and services were above 50 – the cut-off between expected expansion and contraction.

Both the US and Australia are in heated discussions with China over how it handled COVID-19 during the early stages.

US

The weekly initial jobless claims have ramped up sufficiently to make some predict the unemployment rate will exceed 16% at some point. Since many of these unemployed people will be receiving additional benefits, 16% does not mean the same at 16% at some other time. Moreover, there will be many more job vacancies than normal in a recession when restrictions are lifted.

Europe

The UK prime minister, Boris Johnson, was in intensive care with COVID but he is already back in the office. The UK is still aiming for completing the exit from Europe by the December 31st deadline.

Rest of the World

Kim Jung-un, the North Korea premier, has not been sighted for over two weeks and fears for his health abound. As they have an unusual hereditary premiership, and he has no son, the choice of a new leader is, indeed, problematic assuming such transition is required.