In this month’s update, we provide a snapshot of economic occurrences both nationally and from around the globe.

– Australian unemployment rate now the lowest since 1974!

After a dismal June in equity markets, July was like a breath of fresh air. Wall Street’s S&P 500 was up 9.1% on the month while our ASX 200 rose 5.7%. Of course, it’s a long way back to the top, but this is a step in the right direction.

Though, we think it is too early to be convinced that it’s just onwards and upwards from here. A few positive things happened in the last week of July but some, or all of them, could slide back to lower levels.

While we don’t see markets revisiting their June lows however, a meteoric rally like the one from the last week of July needs a bit more substance to sustain it. These short sharp rallies are often referred to as bear-market rallies – and can fizzle out as quickly as they start. In our opinion, the jury is out on this one. It could go either way.

Central banks are at both the heart of the problem and the solution. As analysts we have to try and guess what they will do and measure that against what they should do.

There was a flurry of central bank activity in the first part of July. The Reserve Bank of Australia (RBA), the European Central Bank (ECB), the Reserve Bank of New Zealand (RBNZ), the Bank of Korea (BoK), and the Bank of Singapore (BoS) all hiked their base rates by 50 bps (or 0.5% points). Singapore didn’t even wait for their scheduled meeting. It jumped in, out-of-cycle! The Bank of England (BoE) hiked rates for the fifth month in a row. But there was a notable exception.

The Bank of Japan left rates on hold. They argued, as they did in the 1970s when the two big oil price shocks occurred, that higher interest rates do not cure inflation caused by supply-side shocks. Japan had two stellar decades of growth in the 70s and 80s. Most of the rest of countries hiked rates sharply with the result of being stuck in stagflation. That is, there was high inflation because interest rate policy could not work against the cause and slow economic growth because high interest rates cripple the economy.

When the US Federal Reserve (“Fed”) met towards the end of July, they hiked the Fed funds rate by the expected 0.75% but they were softer in their tones than in previous recent meetings.

Fed chair, Jerome Powell, stressed that some parts of the economy were looking a little weaker and the Fed might be less aggressive going forward. This statement at a press conference immediately inspired a very strong rally in US equity markets.

There are few among us that would not acknowledge that major supply-side blockages have contributed greatly to global inflation: the Russian invasion of the Ukraine (gas pipeline to Europe and blockade of Black Sea ports stopping grain exports, and oil supply from Russia) and supply-chain disruptions caused by pandemic shut-downs.

There are pockets of demand-side inflation caused by mismatching of workers and vacancies as well as workers in general seeking wage increases to compensate for higher energy and food prices.

Of course, Australia has also suffered significant supply disruption from the major flooding along large stretches of the east coast. Various produce such as lettuce have had prices sky-rocket.

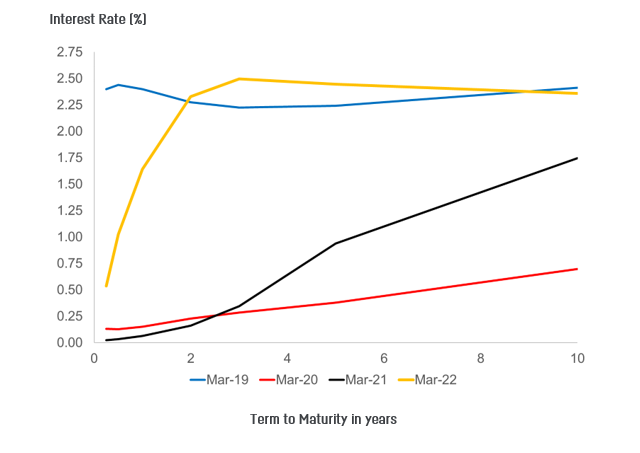

We do not think any of the major central banks have taken us to the brink. They have largely just removed the emergency settings that were introduced more recently because of the pandemic. It is only when rates are pushed past the so-called ‘neutral rate’ that separates ‘expansionary policy’ from ‘contractionary policy’ settings that trouble may emerge. Most seem to agree that the neutral policy interest rate is between 2% and 3%. The US rate is now a range of 2.25% to 2.5%. For them, walking the plank starts from here.

In earlier issues of this monthly update, we argued that the central banks might be intent on doing one thing while saying another. The media and others were howling for rate hikes to crush inflation. Is this first round of hikes and the magnitude of the increases in part to placate the media? We won’t really know until the 21st September Fed meeting. Will they keep going?

The RBA is still way behind the US with its overnight rate at 1.35% even if it hikes as expected on August 2nd to 1.85%.

The US CPI inflation came in at 9.1% annualised for June and even the core measure that strips out food and energy prices was 4.9%. The US Private Consumption Expenditure (PCE) alternative measure, preferred by the Fed, was 6.8% with the core at 4.8%. But it does seem that the increases in inflation rates may have ended or even peaked. Perhaps that was the sentiment that drove equity markets higher in late July.

The fly-in-the-ointment might be US economic growth as measured by Gross Domestic Product (GDP) growth. It was 1.6% in Q1 and 0.9% in Q2. That, for non- economists, might signal a recession. Fed Chair Powell, former Fed Chair Yellen (and now Secretary to the Treasury) and President Biden all stated firmly that the ‘US is not in recession. We strongly agree.

The proper definition of a recession is based on deterioration of economic conditions in many sectors of the economy including the labour market and consumer spending.

The US has witnessed six months of job increases in excess, on average, of 400,000 per month. Before the pandemic, 200,000 new jobs created in a month was considered to be very strong. The unemployment rate in the US is 3.6% or as close to full employment as anyone could wish for. There are about two job vacancies for every one unemployed person. Consumer spending is also holding up.

In Australia, we just recorded the lowest unemployment rate since 1974 and 88,000 new jobs were added for the latest month. While conditions can change rapidly, there is no evidence that the US or Australia are currently anywhere near a recession.

Turkey brokered a deal to get the gas pipeline from Russia to Germany working again after a 10-day so-called ‘period of maintenance’. It worked, but it looks likely that Putin might manipulate the flow to cause rationing at times.

Turkey was also there with the UN to get a deal going on grain shipments out of the Black Sea ports of Ukraine. There are reportedly 80 ships loaded with 20 million tons of grain but we have not yet seen a report that the ships have set sail through the UN-supported shipping corridor.

For very different reasons, ships are lying idle off the US east and west coasts in large numbers. The queue is reportedly about four times normal. There is industrial action in Oakland California that has blocked container movement there but, more generally, ports were working at full capacity, so it is hard to step up turnaround when there aren’t enough resources. One reported blockage is the supply of drivers for the trucks that move the containers. Some of that is due to Covid-related absences.

China is well past its big lockdown for Covid but since they are maintaining the zero Covid policy, there are plenty of pockets of supply disruptions.

While we feel that a supply-side inflation problem is far from being solved, we could be close to improving from a bad place – and that means inflation would fall even if it remains high. Like Japan, we and the US can use fiscal policy to cope with high inflation.

We see the underpinnings of the July equity rally as fragile rather than doomed. Markets critically depend not only on what the central banks do, but also what they say.

International Equities

The S&P 500 also had a bad June ( 8.4%) but cancelled out these loses in July with a gain of 9.1%.

The UK FTSE, the German DAX and the Japanese Nikkei retuned similar amounts to the ASX 200 while China’s Shanghai Composite actually fell 4.3% after a strong June (+6.7%). Emerging markets were flat in July.

The RBA lifted its overnight borrowing rate from 0.85% to 1.35% at its July meeting. The market is pricing in a further ‘double’ hike for August but that would still leave the overnight rate well below the neutral rate.

The Fed was expected to hike by 100 bps after the record-breaking inflation read at the start of July. However, by the time of the meeting, the market had come back to expect a 75-bps hike.

With Jerome Powell calming expectations for future hikes there is a long wait before the 21 September meeting. Important comments might be made at the annual Jackson Hole gathering of global central bankers in the interim.

A plethora of other banks hiked during July: ECB, RBNZ, BoK, BoS and BoE. Although they hiked by 50 bps, the ECB reference rate is still only 0.0%.

10-year rates on government bonds in Australia and the US experienced some wild gyrations in July. They are now back well below the recent highs.

The US 30-yr mortgage rate experienced major falls immediately following the Fed’s 75 bps hike. The market might be paving the way for a pause in the hiking cycle.

There were 88,000 new jobs reported for the month and the unemployment rate dropped sharply from 3.9% to a near 50-year low of 3.5%.

China continues to grapple with its zero Covid policy. As a result, most economic data were weak.

GDP growth came in at 0.4% while retails sales (3.1%) and industrial output (3.9%) also missed expectations.

There were 372,000 new jobs created as reported in the latest monthly labour report while 250,000 had been expected. The unemployment rate remains at an historically low 3.6%.

CPI inflation came in at 9.1% for the year against an expected 8.8%. Core CPI inflation was 5.9%. The Fed-preferred PCE inflation stands at 6.8% and the core variant at 4.9%

The preliminary estimate for GDP in the June quarter was negative at 0.9% in the wake of a 1.6% final estimate for Q1. This does not amount to a recession in and of itself as the US has an economically sound definition of what constitutes a recession.

Fed Chair Powell, President Biden and Treasury secretary Yellen all took great pains to express their view that the US is not in recession. Retail sales in June were up 1.0% for the month but that is less than the current rate of inflation!

The ECB has, at last, hiked its rate to 0.0%! Germany was suffering somewhat from the temporary closure of the Russia gas pipeline.

Britain seems to have come to terms with a rapidly slowing economy. Boris Johnson is to be replaced in the near future as British PM.

Turkey has been active in brokering deals between Russia and the Ukraine over both gas and grain supplies. While this news has been received positively, it is too soon to comment on the success or otherwise of the deals.