Blog - May 9th, 2018

Federal Budget 2018

by Infocus

The 2018-19 Federal Budget that was handed down last night focused more on minor adjustments than sweeping reforms. In our view, it was a Budget designed to create short, sharp election headlines, but there were also measures that will provide financial planning opportunities for many Australians.

One of the more significant announcements was the Government’s determination to reduce personal income tax over stages starting with tax relief for low and middle-income earners from 1 July 2018 and culminating in the elimination of the 37 per cent tax bracket (and increasing the lower threshold of the top tax bracket) from 1 July 2024.

A summary of the key points from the Budget that may affect your financial situation is provided below. Please remember that before any of these announcements can be implemented they will require the passing of legislation and may be subject to change.

A summary of the key budget measures include:

1. Making the tax system easier over the coming years by reducing tax brackets

2. Tax reductions for low and middle-income earners

3. Reduction in fees and a ban on exit fees on all super funds

4. Opt-in insurance for young and low super balance Australians

5. Increasing SMSF members from 4 to 6

6. Super trustees will need to build new retirement income options for their members

7. Expanding the pension loan scheme to all older Australians.

Taxation

Changes to income tax bracket thresholds

From 1 July 2018, the Government will increase the top threshold of the 32.5 percent personal income tax bracket from $87,000 to $90,000.

The Government will increase the Medicare Levy low-income threshold for singles, families and single seniors and pensioners from 2017-18 income year.

Medicare Levy low-income threshold for families

- The threshold for singles will be increased from $21,655 to $21,980.

- The family threshold will be increased from $36,541 to $37,089.

- For single seniors and pensioners, the threshold will be increased from $34,244 to $34,758.

- The family threshold for seniors and pensioners will be increased from $47,670 to $48,385.

- For each dependent child or student, the family income thresholds increase by a further $3,406, instead of the previous amount of $3,356.

2% Medicare Levy retained

The Medicare levy rate will no longer be increased from 2.0 to 2.5 per cent of taxable income from 1 July 2019.

Small business – extending the $20,000 instant asset write-off

The $20,000 instant asset write-off will be extended by a further 12 months to 30 June 2019 for businesses with aggregated annual turnover less than $10 million.

Small businesses will be able to immediately deduct purchases of eligible assets costing less than $20,000 first used or installed ready for use by 30 June 2019. Only a few assets are not eligible (such as horticultural plants and in-house software).

Personal Income Tax Plan

From 1 July 2018, the Government will introduce a seven year Personal Income Tax Plan over three stages that includes:

Step 1: Targeted tax relief to low and middle income earners

A Low and Middle-Income Tax Offset will be introduced. The offset is: a non-refundable tax offset

- – of up to $530 per annum

- – available to Australian resident low and middle income taxpayers

- – available for the 2018-19, 2019-20, 2020-21 and 2021-22 income years

- – received as a lump sum on assessment after you lodge your tax return.

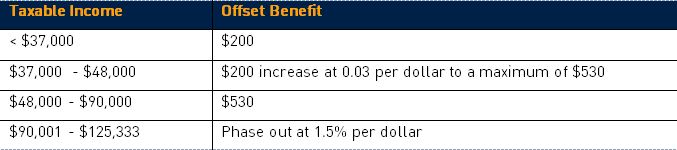

The offset will provide a benefit of:

- – up to $200 for taxpayers with taxable income of $37,000 or less

- – the value of the offset will increase at a rate of three cents per dollar to the maximum benefit of $530, for taxpayers with taxable income between $37,000 and $48,000

- – the maximum benefit of $530 for taxpayers with taxable incomes from $48,000 to $90,000

- – the offset will phase out at a rate of 1.5 cents per dollar for taxpayers with taxable incomes from $90,001 to $125,333. The benefit of the offset is in addition to the existing Low Income Tax Offset (LITO).

Step 2: Protecting middle income Australian from bracket creep

The top threshold of 32.5 per cent personal income tax bracket will be increased from $87,000 to $90,000. This measure takes effect from 1 July 2018. Other measures include:

- LITO will be increased from $445 to $645 (and withdrawn at a rate of 6.5 cents per dollar between incomes of $37,000 and $41,000, and at a rate of 1.5 cents per dollar between incomes of $41,000 and $66,667)

- 19 per cent personal income tax bracket will be extended from $37,000 to $41,000

- top threshold of the 32.5 per cent personal income tax bracket will be increased from $90,000 to $120,000. These measures take effect from 1 July 2022.

Step 3: Ensuring Australians pay less tax by making the system simpler

The 37 per cent tax bracket will be removed entirely:

- top threshold of 32.5 per cent personal income tax bracket will be increased from $120,000 to $200,000.

- Taxpayers will pay the top marginal tax rate of 45 per cent from taxable incomes exceeding $200,000 and the 32.5 per cent tax bracket will apply to taxable incomes of $41,001 to $200,000.

These measures take effect from 1 July 2024.

Superannuation

Capping passive fees, banning exit fees and consolidating small and inactive super accounts

From 1 July 2019, there will be a three per cent annual cap on passive fees charged by superannuation funds on accounts with balances below $6,000 and exit fees will be banned on all superannuation accounts. In addition, all inactive superannuation accounts with balances below $6,000 will need to be transferred to the ATO.

Changes to insurance in superannuation

From 1 July 2019, insurance in superannuation will only be able to be offered on an opt-in basis for:

- members with low balances of less than $6,000;

- members under the age of 25 years; and

- members whose accounts have not received a contribution in 13 months and are inactive.

Work test exemption for recent retirees

From 1 July 2019, the Government will introduce an exemption from the work test for voluntary contributions to superannuation, for people aged 65-74 with superannuation balances below $300,000, in the first year that they do not meet the work test requirements. This measure will allow contributions to be made for an additional 12 months.

Increasing the maximum number of allowable members in SMSFs and small APRA funds from four to six

From 1 July 2019, the maximum number of members permitted in new and existing self-managed superannuation funds and small APRA funds will be increased from four to six.

Three-year audit cycle for some SMSFs

From 1 July 2019, self-managed superannuation funds with a history of good record-keeping and compliance will be subject to a three-yearly audit requirement rather than an annual audit requirement.

Retirement Income

The Government announced it is developing a retirement income framework to increase flexibility and choice for retirees and help boost living standards.

Comprehensive Income Products for Retirement

The superannuation law will be amended to introduce a retirement covenant that will require superannuation trustees to formulate a retirement income strategy for superannuation fund members. The intention is to focus the industry on providing a higher standard of living for retirees.

The covenant will require trustees to offer Comprehensive Income Products for Retirement (CIPRs): products that provide individuals income for life, no matter how long they live. Offering a CIPR would be a core part of how trustees implement the retirement income strategy developed for their members.

Social Security

Pension Work Bonus

From 1 July 2019, the Pension Work Bonus will increase from $250 to $300 per fortnight with the maximum unused amount that can be accrued increasing to $7,800 (up from $6,500).

In addition, the Government will extend the Pension Work Bonus to those who are self-employed. However, a ‘personal exertion’ test will be introduced to ensure the Pension Work Bonus is only available to those who are engaged in gainful work and not to those receiving passive income such as income from real estate.

Expanding the Pension Loan Scheme

From 1 July 2019, the Government will expand eligibility to the Pension Loan Scheme to include all Australians of Age Pension age. The Government will also increase the loan amount so that an individual can receive a fortnightly amount up to 150 per cent of the maximum Age Pension rate.