In this special report, our Head of Professional Standards & Technical Services, Craig Meldrum, looks at the key takeouts from the federal budget and what it means for individuals and businesses for tax, superannuation and social security that may impact wealth creation and retirement funding strategies for Infocus’ advisers and clients.

The macro

On Tuesday, 11 May 2021, Treasurer Josh Frydenberg handed down the 2021-22 Federal Budget. It was his third Budget but more interestingly, this was the second “Covid” budget and unsurprisingly did not reprise any of the catch-cries of “debt and deficit” or “return to surplus” from the pre-Covid era (which seems a long time ago now). With a Federal election looming next year, and in what the ABC’s political correspondent, Andrew Probyn, referred to as the “hot chocolate budget”, this budget had all the hallmarks of a pre-election cash-splash with more spending to ensure a continued recovery out of the Covid-fueled economic black hole.

Given the massive challenges for both the federal and state governments in managing the health impacts of the pandemic, including various random state-based outbreaks (generally from hotel quarantine), the further economic impacts to tourism and education while the borders remain closed and the slow pace of the vaccine rollout, Australia has actually done much better than expected. Last year’s federal budget predicted a deficit of $213.7 billion which was forecast to fall to $66.9 billion by 2023-24, representing 36% of GDP. Treasury has recast those figures and forecast a better, but still eye-watering deficit of $161 billion, reducing to $57 billion by 2024-25.

Total net debt was expected to reach $703 billion this year and was forecast to peak at a record $966 billion by June 2024. Those figures have now reduced to $617 billion, representing 30% of GDP and expected to peak at $980.6 billion in 2025 (40.9% of GDP). Australia’s successful transition out of its debt-fueled recovery does rely on a few assumptions including having the entire population fully vaccinated, re-opening the borders and continuing to enjoy the tax receipts from China’s strong demand for our iron ore. The continued rollout of the vaccine and strong fiscal policy are expected to see real GDP grow by 5.25% during the 2021 year, (after it fell by 2.5 per cent in 2020).

Australia has also rebounded well with its unemployment figures. After initially forecasting a Covid-induced unemployment rate of up to 15%, Australia is currently sitting at 5.6% which Treasury has forecast will fall below 5% by late 2022 and should reach 4.75% in the June quarter of 2023. Like last year, this budget is all about continuing to build business confidence and create more jobs. Businesses can benefit from further tax incentives for investing in innovation and the instant asset-write off will continue. The Treasurer also made big spending commitments on infrastructure, housing and traineeships to further boost job creation.

The Government has also put more of a focus on women in this budget, following the establishment of a dedicated taskforce earlier this year, with measures targeted towards women’s safety, economic security, and health and wellbeing.

The government has committed $1.9 billion to a Women’s Economic Security Package, including $1.7 billion flowing towards an increased childcare subsidy over five years, for families with second and subsequent children aged five years and under.

Noting that women generally have a lot less in their superannuation than men by the time they retire, the Government has also scrapped the $450 per month minimum income threshold for eligibility for superannuation guarantee contributions from employers, benefiting low-income workers.

Besides further spending to implement the comprehensive Digital Economy Strategy and a range of measures in health, the Government has dedicated $17.7 billion to improving the aged care system following on from the recent royal commission into aged care, including adding 80,000 new HomeCare places (275,000 in total). Further big-ticket items include $13.2 billion for the National Disability Insurance Scheme (NDIS) and $2.3 billion towards a National Mental Health and Suicide Prevention Plan.

More detail on a few of the measures

Personal taxation

There were no changes announced to the Government’s already-legislated three-stage tax plan that was announced in 2018 and enhanced in 2019. As a reminder;

- Stage 1 amended the 32.5% and 37% marginal tax brackets over 2018-19 to 2021-22 and introduced the Low- and Middle-Income Tax Offset (LMITO);

- Stage 2 was designed to further reduce bracket creep over 2022-23 & 2023-24 by amending the 19%, 32.5% and 37% marginal tax brackets; and

- Stage 3 was aimed at simplifying and flattening the progressive tax rates for 2024–25 and increasing the Low-Income Tax Offset (LITO). The Government estimated that around 95 per cent of taxpayers would be on a marginal tax rate of 30% or less (as shown in the tables below).

3 Stage Tax Plan

| Tax rates (2017-18) | Thresholds | Tax rates (2018-19 to 2021-22) | Thresholds |

| Nil | $0 – $18,200 | Nil | $0 – $18,200 |

| 19% | $18,201 – $37,000 | 19% | $18,201 – $37,000 |

| 32.5% | $37,001 – $87,000 | 32.5% | $37,001 – $90,000 |

| 37% | $87,001 – $180,000 | 37% | $90,001 – $180,000 |

| 45% | $180,000 + | 45% | $180,000 + |

| LITO | Up to $445 | LITO | Up to $445 |

| LMITO | – | LMITO | Up to $1,080 |

| Tax rates (2022-23 & 2023-24) | Thresholds | Tax rates (2024-25) onwards | Thresholds |

| Nil | $0 – $18,200 | Nil | $0 – $18,200 |

| 19% | $18,201 – $45,000 | 19% | $18,201 – $45,000 |

| 32.5% | $45,001 – $120,000 | 30% | $45,001 – $200,000 |

| 37% | $120,001 – $180,000 | – | – |

| 45% | $180,000 + | 45% | $200,000 + |

| LITO | Up to $700 | LITO | Up to $700 |

| LMITO | – | LMITO | – |

The Stage 3 personal income tax cuts will proceed as originally planned, commencing on 1 July 2024. The tax rate above taxable income of $45,000 will drop from 32.5% to 30%, and the rate of 45% will apply above $200,000, eliminating the 37% tax bracket.

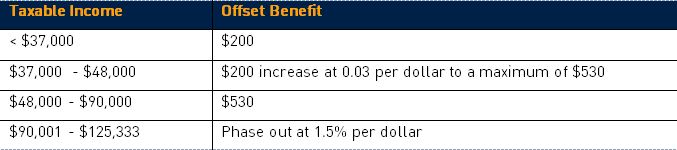

The LMITO will be extended to 2021–22. Originally legislated for 4 years, the LMITO was then reduced to 2 years and due to end on 30 June 2021. The 12-month extension means it will end 30 June 2022. The rates and thresholds remain unchanged.

The reduction in tax provided by LMITO will remain at $1,080 per annum ($2,160 for dual-income couples) with the base amount at $255 per annum for the 2020-21 income year.

| Taxable Income (TI) | LMITO |

| $0 – $37,000 | $255 |

| $37,001 – $48,000 | $255 + ([TI – $37,000] × 7.5%) |

| $48,001 – $90,000 | $1,080 |

| $90,001 – $125,999 | $1,080 – ([TI – $90,000] × 3%) |

| $126,000 + | Nil |

In another personal tax measure, the $250 threshold for self-education expenses is to be removed.

Superannuation

Superannuation, which was fairly well ignored in last year’s budget, got some needed tweaks but no wholesale changes. The following provides a short summary on each of the proposed measures.

The Work Test

Since 1 July 2020, the work test is required to be satisfied by those aged 67–74 (65–74 before 1 July 2020) to make voluntary contributions to superannuation. However, it was announced that the work test will be removed completely. This measure is expected to take effect from 1 July 2022.

Interestingly (or frustratingly), there is still no sign of the extension of the Non-Concessional Contribution (NCC) Cap bring forward measure (the bill that is still stuck in the Senate sought to align the bring forward contribution rules with the provision that removed the work test for 65 and 66 year olds where the Total Super Balance is below $300,000). With the work test scrapped, it is not known whether the bring forward rule will now be opened up for eligible contributions above 65.

$450 per month minimum income level for SG support

As mentioned above, the current minimum income threshold of $450 per month will be removed. The measure is expected to start from 1 July 2022. This means lower income earners, many of them women, will become entitled to superannuation guarantee support regardless of their level of income.

At the same time, the Budget did not contain any change to the legislated Super Guarantee rate increase from 9.5% to 10% for 2021-22.

Downsizer contributions

The age for making downsizer contributions (up to $300,000 of proceeds per member of a couple from selling the principal residence of at least 10 years) will be reduced from 65 to 60. This measure is expected to take effect from 1 July 2022. Downsizer contributions are not included in the NCC cap.

First Home Super Saver Scheme

As well as some technical amendments, the maximum amount of voluntary contributions that can be released under the First Home Super Saver Scheme will increase from $30,000 to $50,000. This measure is expected to take effect from 1 July 2022.

SMSF and SAF residency requirements

The residency requirements for SMSFs and small APRA funds will be relaxed by

- extending the central management and control test safe harbour from 2 to 5 years for SMSFs; and

- removing the active member test for both fund types.

This measure and is expected to take effect from 1 July 2022.

Early release of super to victims of family and domestic violence

The Government will not proceed with a measure to extend early release of superannuation to victims of family and domestic violence. The measure was previously announced on 21 November 2018.

Conversions of legacy income streams

Individuals will be permitted to exit certain legacy retirement income stream products (excluding flexi-pensions or lifetime products in APRA-funds or public sector schemes), together with any associated reserves, for a 2-year period. Any commuted reserves will not be counted towards an individual’s concessional contribution cap. Instead, they will be taxed as an assessable contribution for the fund.

Superannuation thresholds from 1 July 2021 to 30 June 2022

| Threshold type | Amount |

| Transfer Balance Cap | $1.7 million |

| Concessional Contribution Cap | $27,500 |

| Non-concessional Contribution Cap | $110,000 or $330,000 over 3 years |

| Low rate cap | $225,000 |

| Untaxed Plan cap | $1,615,000 |

| Account based pension payments | 50% Covid reduction to minimum payment standards ended |

| Superannuation Guarantee | 10% |

| Maximum Super Contribution Base | $58,920 (per quarter) |

| Government Co-contribution ($500) | Lower income threshold – $41,112 Upper income threshold – $56,112 |

Social Security and Aged Care

The budget did not contain any large social security measures.

Pension Loans Scheme (PLS)

The Government has announced that they will be increasing the flexibility of the Pension Loans Scheme (PLS) by allowing participants to access up to two lump sum advances in any 12-month period up to a total value of 50% of the maximum annual rate of the aged pension.

The total PLS is currently around $12,385 per year for singles and $18,670 couples (combined). The Government has also announced it will introduce a No Negative Equity Guarantee which means that when the house is sold, the Government will not claim back more than the sale price of the house used to guarantee the payment

Family Home Guarantee

The new Family Home Guarantee will allow single parents with dependants to purchase a home with as little as a 2% deposit.

Aged Care

The Government will invest a total of $17.7 billion on aged care reform over five years, including:

- $6.5 billion for 80,000 additional Home Care Packages over the next two years;

- $798.3 million for to provide greater access to respite care services and payments to support carers;

- $7.8 billion for a new funding model for residential aged care, with a $10 per person per day supplement of the Basic Daily Fee;

- $189.3 million over four years from 2020-21 to implement the new funding model, the Australian National Aged Care Classification (AN-ACC); and

- $117.3 million to support structural reforms, including the implementation of a new Refundable Accommodation Deposit (RAD) Support Loan Program.

Business taxation

A welcome announcement was an extension to the measure announced in the 2020 Budget that was designed to improve cash flow and to encourage new investment to support the economic recovery whereby eligible assets (including new depreciable assets and the cost of improvements to existing eligible assets, and for small and medium-sized business, second-hand assets) acquired from 7:30pm (AEDT) on 6 October 2020 and first used or installed by 30 June 2022, could be fully expensed in year of first use. The Government will extend temporary full expensing for 12 months until 30 June 2023.

Further, eligible businesses with an aggregated turnover of less than $5 billion can deduct the cost of eligible depreciating assets of any value acquired from 7:30pm (AEDT) on 6 Oct 2020 and first used or installed ready for use by 30 June 2023. Normal rules will apply from 1 July 2023. The Government also announced that it will extend loss carry back for eligible companies by 12 months to allow them to carry back losses from 2022–23 to offset tax paid on profits as far back as 2018–19 when they lodge their 2022–23 tax return.

The Administrative Appeals Tribunal (AAT) will be given the power to pause or modify ATO debt recovery action in relation to disputed debts of small businesses. This is expected to improve efficiency by keeping these matters out of the courts.

Conclusion and where to from here?

Moving on from the 2020 budget, which was loaded with the largest injection of economic stimulus Australia has ever seen to “keep the ship afloat” during the economic calamity wrought by the pandemic, the 2021 budget has continued on with the theme of further economic stimulus and with all the trimmings of a pre-election cash splash ahead of next year’s election. It has enough sweeteners to woo a broad range of voters, but we’ve seen it does rely on continued economic activity, full vaccination and growing business and consumer confidence, which will be turned on its head if Australia doesn’t maintain its keen focus on managing the virus.

Similar to last year, the Government will continue to pull the fiscal levers to generate jobs and provide the tax incentives to foster business and individual confidence to invest and grow.

As with all budget announcements, the measures are proposals only and need to be enacted by Parliament.

If you have any specific questions, please contact your financial adviser.

General Advice Warning

The information in this presentation contains general advice only, that is, advice which does not take into account your needs, objectives or financial situation. You need to consider the appropriateness of that general advice in light of your personal circumstances before acting on the advice. You should obtain and consider the Product Disclosure Statement for any product discussed before making a decision to acquire that product. You should obtain financial advice that addresses your specific needs and situation before making investment decisions. While every care has been taken in the preparation of this information, Infocus Securities Australia Pty Ltd (Infocus) does not guarantee the accuracy or completeness of the information. Infocus does not guarantee any particular outcome or future performance. Infocus is a registered tax (financial) adviser. Any tax advice in this presentation is incidental to the financial advice in it. Taxation information is based on our interpretation of the relevant laws as at 1 July 2020. You should seek specialist advice from a tax professional to confirm the impact of this advice on your overall tax position. Any case studies included are hypothetical, for illustration purposes only and are not based on actual returns.

Infocus Securities Australia Pty Ltd (ABN 47 097 797 049) AFSL No. 236 523.