The silly season is here, and while many people are filled with the festive spirit, many others are filled with stress and dread.

But Christmas doesn’t have to be a nightmare if you plan ahead and use a little technology!

Budget & lists

The best way to avoid bill shock in the new year is to plan exactly what you’re going to buy for who, and only buy that. As tempting as window shopping can be, it’s easy to overspend or buy things just because they’re on sale. It might help to check catalogues in your letterbox or compare prices online to find the best deal.

It may also help to visit an ATM as soon as you get to the shopping centre and withdraw your Christmas budget – that way once it’s gone, it’s gone. Alternatively, set a low limit on your credit card so you don’t overspend.

Click & collect

Many retailers now offer click and collect options that can take the stress out of walking the aisles, especially if you’re time poor leading into Christmas. It can also help with carpark rage, as you may be able to use express parking or collect from a designated collection point.

Avoid peak shopping times

The Commonwealth Bank has crunched the numbers and found that Saturday December 16, or Super Saturday, is likely to be the busiest shopping day in the lead up to Christmas (based on last year’s data). As Christmas Day falls on a Monday this year, Saturday December 23 is also likely to be busy.

Stores are generally able to open until midnight the week before Christmas (depending on your state), so take advantage of this late trade. Roy Morgan data shows Monday is the least popular day for grocery shopping, so that could be a great time to make your way to the shopping centre.

Whatever happened to homemade?

Once upon a time, gifts were made at home with love, but that seems to have fallen by the wayside.

It’s these gifts that are often more thoughtful, labour intensive and highly appreciated – and they can cost you less money. Think about homemade tree decorations, cakes or biscuits or even a simple but nicely decorated homemade card instead of ‘stocking stuffers’ this year.

Don’t forget your ship when you shop

If you’re shopping online this Christmas, don’t forget to factor in delivery times to avoid long faces on Christmas Day. Australia Post advises that 1pm Thursday December 21 is absolutely the last day to send anything via Express Post to arrive before Christmas.

Parcels and cards can take anywhere between 2 and 6 business days to be delivered, meaning you’ll want to have your shopping done by Thursday December 14 if your merchant uses Australia Post.

Some online stores may use a dedicated courier service which may bring down this deadline, so be sure to check with your favourite store to avoid disappointment.

Keep your receipts

Even if you give something as a gift, keep the receipt for warranty and refund purposes. It is far easier to return or exchange an item if you have proof of purchase. If you’ve given a gift that is not fit for purpose or is faulty, consumer protection still applies. Read more about consumer rights and guarantees here.

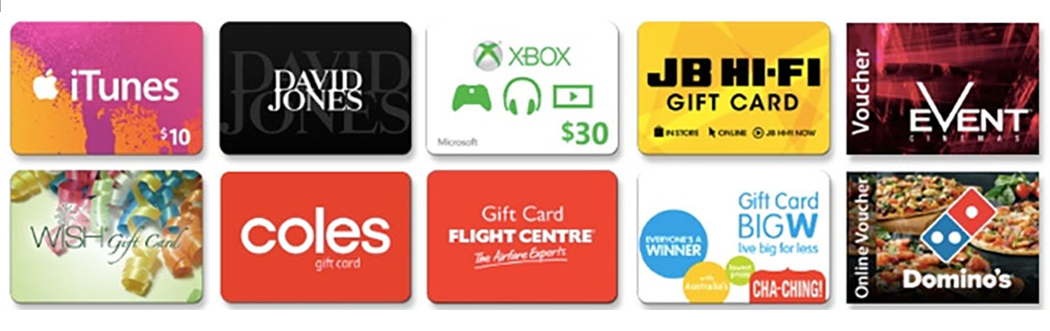

Gift cards DO expire

Gift cards make a quick and easy present for that hard-to-buy-for person in your life. But not everyone is using them before they expire, boosting retailers bottom lines to the tune of about $71million a year. Although laws to ban or limit expiry dates on gift cards are planned (in NSW, gift cards will have a minimum 3 year expiry from March 2018), for now – if you don’t use it, you lose it. The standard expiry date is 12 months from the date of purchase, so ensure the retailer clearly writes this date on the card when you purchase. Then nag your friends and family to make sure they spend it!

Boxing Day

We’ve seen the news stories with crowds flooding Myer and David Jones at 6am on Boxing Day. It’s easy to get caught up in the hype of huge discounts on big sale days, but only buy what you need. It can be a great chance to stock up on linen, underwear and work clothes, and it’s easy to grab items just because they are 70% off.

Much like Christmas shopping, a great tactic is to plan ahead, check out the deals online ahead of time, and write a list of where you’re going and how much you’re going to spend – then stick to it. It may not be as fun as a frenzy, but you’ll still get great deals without the bill shock later. Many retailers start their sales on Christmas Day, giving you the opportunity to get in nice and early.

Top tips:

• Plan ahead: make a list, set a budget and stick to it

• Instead of buying all your gifts, try making some

• Avoid the biggest shopping days by shopping earlier in the week and late at night

• Keep your receipts, even for gifts

• Don’t get sucked in by big discounts on Boxing Day